My country's electrochemical energy storage will reach 11.4GW in 2022, and the market cost in 2022 will have a large room for decline. In the current domestic electrochemical energy storage market, lithium iron phosphate batteries are the veritable mainstream due to considerations of cost, safety, and other issues. The electrochemical installed capacity of the energy storage market has been overgrown. Under the influence of the Russian-Ukrainian war, the European market has improved the economy of household storage; driven by the domestic mandatory allocation and storage policy, the domestic and overseas markets have ushered in resonance.

The vanadium battery energy storage project has good prospects

Green and low carbon have become a new development direction for many industries. In this context, the energy storage industry has ushered in rapid development, and vanadium batteries have become a new trend in the energy storage industry due to their safety and ultra-long cycle times. Listed companies such as CNNC are actively deploying in related fields. Vanadium battery technology is one of the representative new chemical energy storage technologies, with good prospects and a steady increase in market share in the future.

The full name of the vanadium battery is an all-vanadium redox flow battery, a kind of redox battery whose active material is in a circulating liquid state. Vanadium batteries have the advantages of high stability, long cycle life, and substantial capacity expansion. They are suitable for long-term energy storage projects of more than 8 hours. They can be widely used in renewable energy grid-connected power generation, urban power grid energy storage, small power supply, UPS systems, etc. China Nuclear Titanium Dioxide, a listed company in the titanium dioxide field, announced on July 8 that the company and We lead signed a strategic cooperation agreement on the "All-vanadium flow battery energy storage industry chain." The two parties will focus on the all-vanadium flow battery energy storage industry. The chain has carried out comprehensive and in-depth cooperation, established a long-term, stable and resource-coordinated strategic partnership based on Gansu, and deployed the national long-term energy storage market, making positive contributions to the realization of the "dual carbon" goal.

Vanadium battery energy storage project has a good prospect, and the demand for energy storage will further explode

As a resource leader upstream of the vanadium battery industry chain, Panzhihua Iron and Steel Vanadium and Titanium has recently gained popularity due to the concept of "vanadium battery." According to a research report by Shenyin & Wanguo Securities, Pangang Vanadium and Titanium successfully acquired Pangang Group Xichang Vanadium Products Technology Co., Ltd. in 2021. The production capacity of vanadium products will reach 40,000 tons per year, ranking first in China and the world. The output in 2021 is about 32% and 21%, respectively.

In September 2021, Panzhihua Iron and Steel Vanadium and Titanium announced that it had signed a strategic cooperation agreement with Dalian Borong. According to the development of the energy storage industry, the two parties discussed joint investment to build a vanadium electrolyte factory and gradually expand the scale of the vanadium battery industry. In the later stage, according to the growth of the energy storage market, the two parties will start cooperation in the production of vanadium battery energy storage equipment on time, and the production capacity will be matched with the production capacity of vanadium electrolyte. The reporter noticed that several A-share listed companies with vanadium battery-related businesses had attracted the attention of investors. On the interactive platform of the Shenzhen Stock Exchange and the Shanghai Stock Exchange, the number of questions from investors about "vanadium batteries" has reached hundreds.

2022-2027 China's energy storage equipment industry investment analysis and the "14th Five-Year" development opportunity research report said that when interacting with investors, Shanghai Electric stated that the company is committed to independent research and development of vanadium battery products and has successfully developed a specific effect of 5kW/ The 25kW/50kW stack can be integrated with a 100kW/MW containerized all-vanadium flow battery energy storage system. State Grid Yingda stated that the company has launched the "Comprehensive Energy Project (including vanadium battery energy storage) of the new charging tower on the west side of Hankou Railway Station" in 2022 and is advancing the preliminary work of other related energy storage projects. Longbai Group said that the company's battery materials research institute is researching and developing vanadium battery technology and reserves-related technologies. In the future, it will actively promote the industrialization of vanadium battery materials according to the market situation of vanadium batteries.

In addition, in April 2022, Hyde Co., Ltd. signed a cooperation agreement with China Vanadium Energy Storage and China Technology. Anning Co., Ltd., Western Mining, and other companies also expressed through the investor interaction platform that the relevant business layout involves the vanadium battery industry chain.

Further outbreak of energy storage demand

On July 8, Penang Technology, a leading energy storage stock, broke through 447 yuan in intraday trading. In mid-March, the store was just over 112 yuan. In just over two months, the stock price has nearly tripled. Energy storage concept stocks such as Penghui Energy and KSTAR rose almost 150%. Since the end of April, the energy storage index's market performance has increased by nearly 50%.

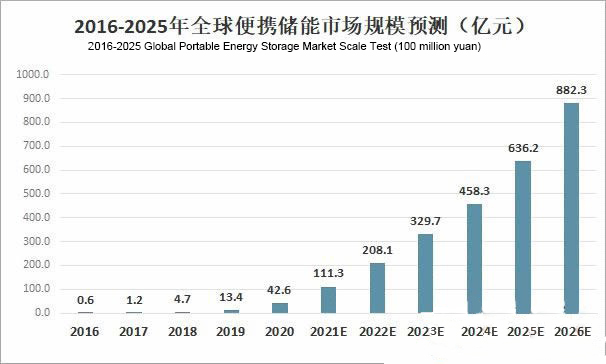

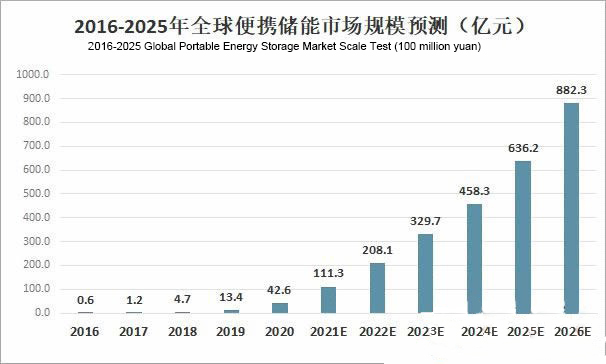

The surge in the energy storage sector is directly related to solid market demand. Affected by the sharp rise in overseas traditional energy prices, European users' need for energy storage has exploded, bringing substantial market opportunities to Chinese manufacturers. Yuan Wei of Changan Fund said standard energy prices in overseas markets had risen sharply. Under the market-based pricing system, the price difference of time-of-use electricity prices has increased, making household energy storage more economical. Residents store electricity at night when electricity prices are low or store their rooftop photovoltaic power generation, which is more cost-effective than regular purchases, directly leading to the explosion of energy storage demand.

A private equity fund manager in South China said that my country's wind power, photovoltaics, and other renewable energy power generation have strong momentum. Due to the volatility and intermittent characteristics of new energy power generation, there is an unprecedented massive demand for energy storage. In addition, driven by the continuous advancement of technology, the cost of new energy storage, such as electrochemical energy storage, continues to decline, and the cost performance is also gradually improving.