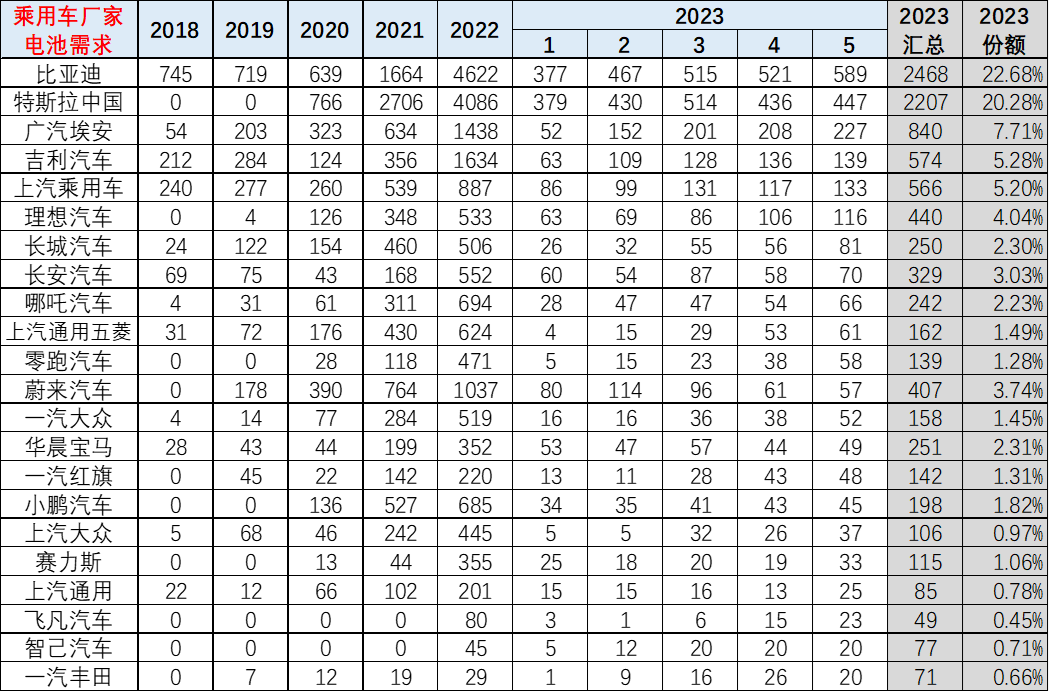

Strong growth in passenger car battery demand January-May BYD and Tesla battery demand accounted for 43%

On June 25, Cui Dongshu, secretary-general of the Passenger Association, released an analysis of the new energy vehicle lithium battery market in May 2023 through his personal WeChat public number. In the past two years, the new energy vehicle and energy storage industries have been highly prosperous, with a sharp increase in demand for batteries and a decline in the installed ratio of batteries for new energy vehicles. With the intensification of the conflict between Russia and Ukraine and the increasing share of new energy storage, the demand for energy storage has skyrocketed. Due to the high price of nickel and cobalt, forming the differentiated growth of ternary lithium batteries and lithium iron phosphate batteries. Lithium iron phosphate batteries reached 68% of the total, becoming a recent growth hotspot. With the continued strength of plug-in hybrid, it is expected that the growth of battery-installed demand for electric vehicles will be slower than the growth of the total number of vehicles.

Cui Dongshu: It is expected that the growth of battery installation demand for electric vehicles will be slower than the growth of the total number of vehicles

Cui Dongshu said that the current power battery production in the proportion of installed vehicles is constantly decreasing. Data show that in 2020 the power battery installed in the production battery installed rate reached 76%, in 2021 is 70%, in 2022 54%, and in 2023 51%. Among them, the proportion of ternary batteries installed is also gradually reduced, from 80% to 48% of the proportion in 2023, while lithium iron phosphate was from 71% to 56% of the proportion, both reproduction and inventory of relative performance pressure.

With the development of industries such as energy storage, especially the world energy crisis brought about by the Russian-Ukrainian crisis, energy storage, and other industries, battery demand is growing rapidly, resulting in a more significant decline in the proportion of installed batteries.

The growth rate of power batteries in 2021 and 2022 is lower than the growth rate of the whole car, and the growth rate of power batteries this year is the same as the growth rate of the whole car.

Cui Dongshu: It is expected that the growth of demand for electric vehicle battery installation will be slower than the growth of the total number of vehicles

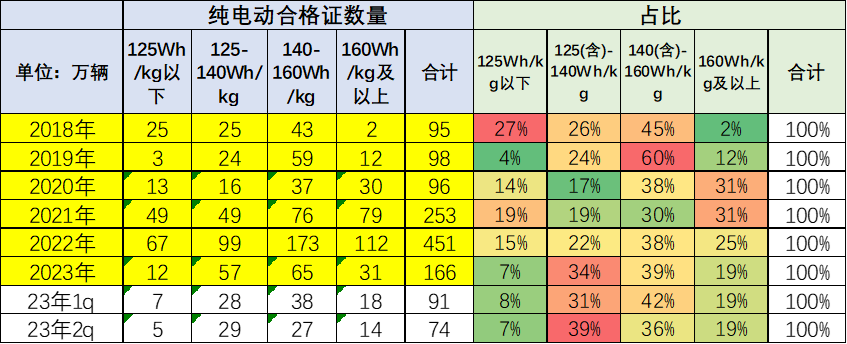

In addition, Cui Dongshu also said that the growth in demand for power battery installation is fluctuating, and the ternary share of domestic sales models qualified for battery installation has dropped significantly.

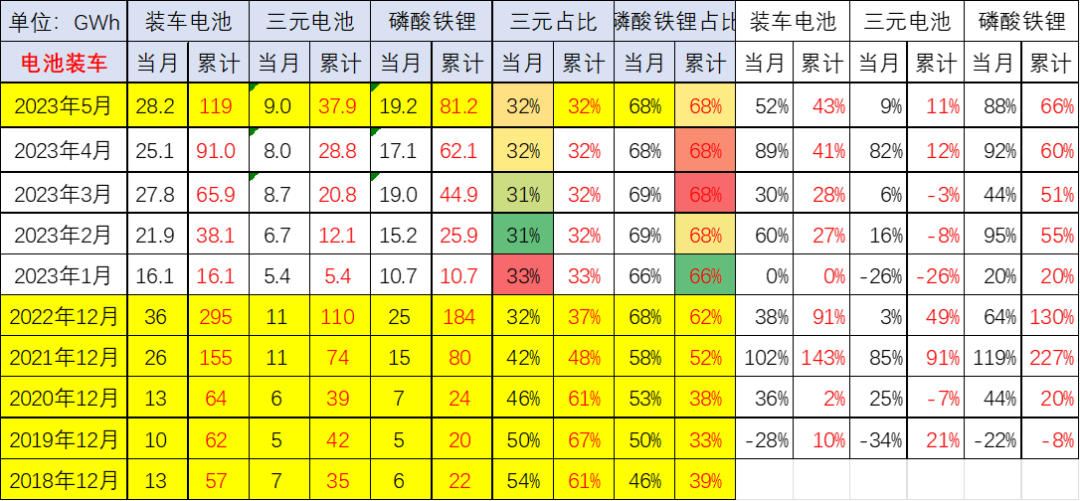

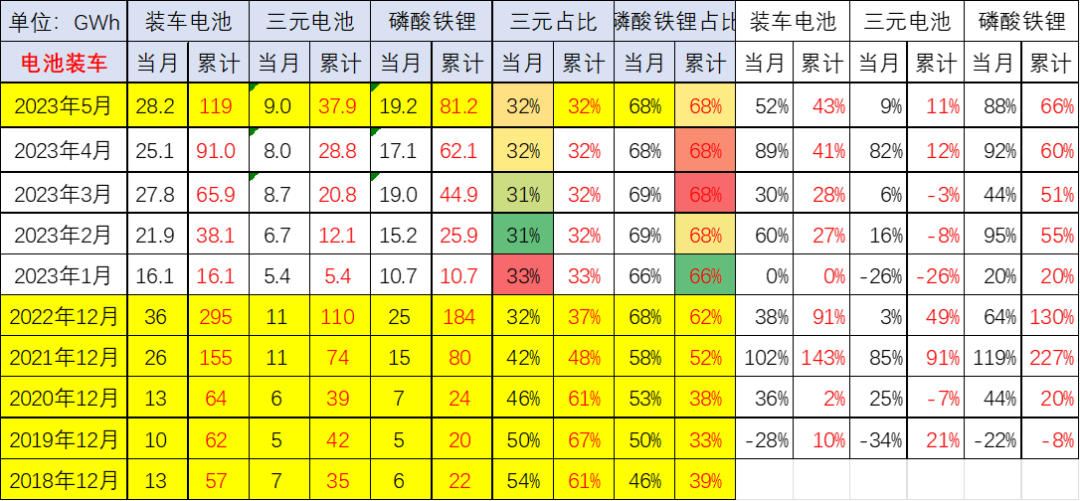

Data show that demand growth of 10% in 2019; in 2020 domestic sales models power batteries installed 64GWh, demand growth of 2%; in 2021 power batteries installed 155GWh, demand growth of 143%; in 2022 installed 295GWh, with a demand growth of 91%; May 2023 installed 28GWh demand growth of 52%. Among them, the ternary battery 2019 growth of 21%; 2020 down 7%; 2021 growth of 91%; 2022 growth of 49%; and 2023 January-May year-on-year growth of 11%. Lithium iron phosphate battery growth is relatively large, with 20% growth in 2020; 227% growth in 2021; 130% growth in 2022; and 66% growth in January-May of 2023.

In 2022, the power battery installation volume of 295GWh, an increase of 91% year-on-year. Among them, ternary batteries installed 110GWh, accounting for 37% of the total installed capacity, an increase of 49% year-on-year; lithium iron phosphate batteries installed 184GWh, accounting for 62% of the total installed capacity, an increase of 130% year-on-year.

From January to May 2023, the installed volume of power batteries was 119GWh, an increase of 43% year-on-year. Among them, ternary batteries installed 38GWh, accounting for 32% of the total installed capacity, an increase of 11% year-on-year; lithium iron phosphate batteries installed 81GWh, accounting for 68% of the total installed capacity, an increase of 66% year-on-year.

Cui Dongshu: EV battery installation demand growth is expected to be slower than the growth of the total number of vehicles

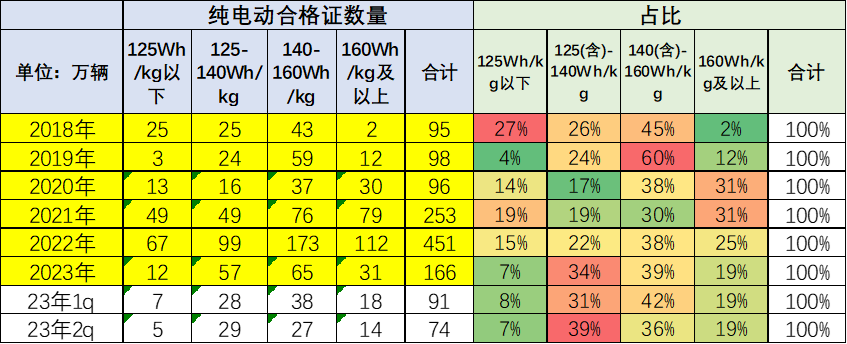

In Cui Dongshu's view, lithium iron phosphate battery demand to improve. Pure electric vehicle current main battery energy density range between 125 to 160, especially the recent performance is more prominent 140 to 160 battery accounted for a relatively high proportion, reaching 36% of the proportion. But the energy density of 160 or more batteries relative to 2020 there was a significant decline, which is mainly lithium iron phosphate battery to ternary replacement brought about by the decline in energy density. And below 125 energy density products also appeared a small decline in the trend, from 14% in 2020 to the current proportion of 7%.

Cui Dongshu: It is expected that the growth of EV battery installation demand will be slower than the growth of the total number of vehicles

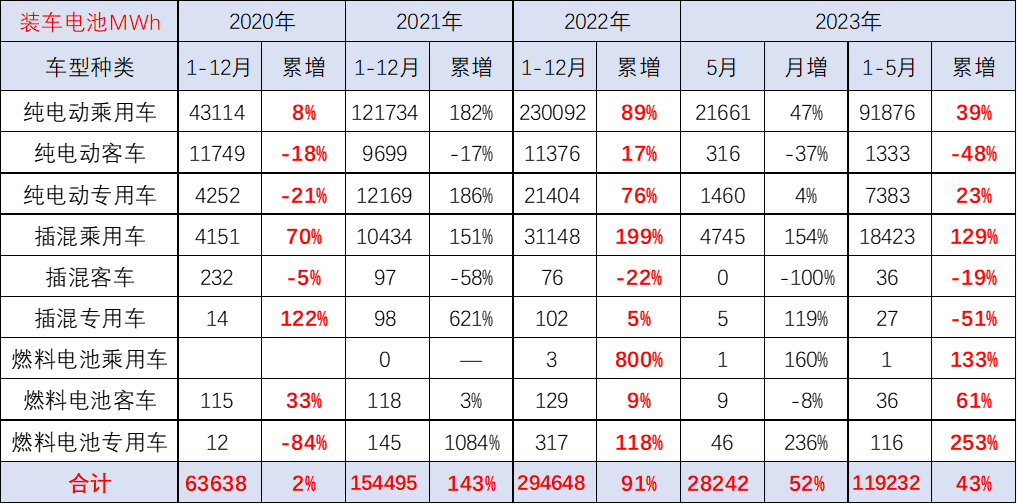

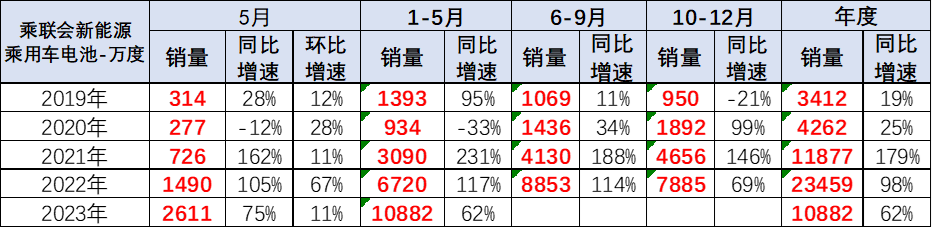

Cui Dongshu analysis, passenger car battery demand growth continues to be strong. Data show that the battery demand for pure electric passenger cars in 2023 will grow 39%, while the battery demand for plug-in passenger cars will grow 129%, continuing strong growth. Battery demand for passenger cars is relatively sluggish. Battery demand for special-purpose vehicles is also growing faster.

Cui Dongshu: It is expected that the growth of EV battery installation demand will be slower than the growth of the total number of vehicles

Cui Dongshu: It is expected that the growth of the installed demand for electric vehicle batteries will be slower than the growth of the total number of vehicles

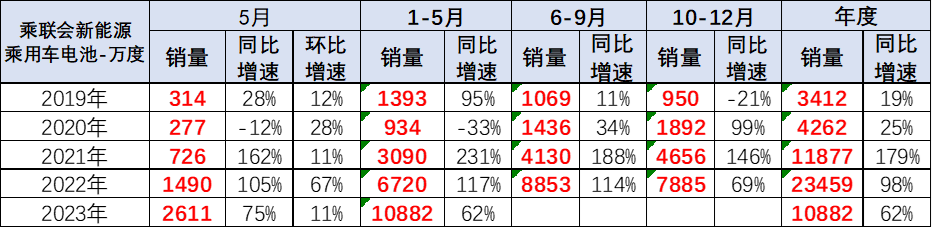

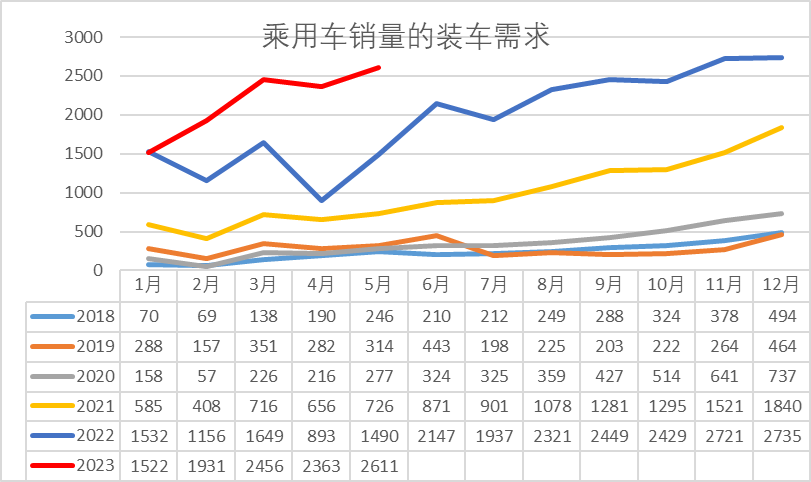

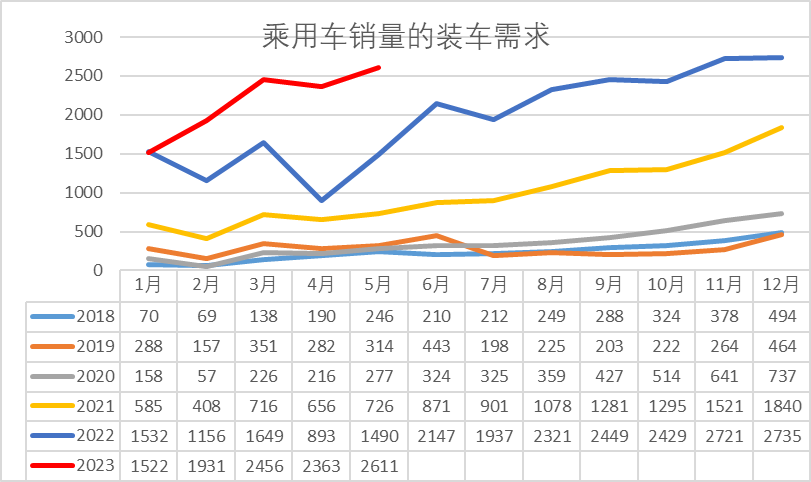

The installed battery for domestic and international sales of passenger cars nationwide was 2,611 degrees in May, and 10,882 degrees from January to May, showing strong growth overall, with a growth rate of 62%. In addition, the battery demand corresponding to the passenger car sales according to the Passenger Car Association showed a stronger trend. Considering the battery demand of 21.47 million degrees for the same period in June, the current demand of 26.11 million degrees for May sales is already high, and June is expected to hit a record high.

Cui Dongshu: It is expected that the growth of the installed demand for electric vehicle batteries will be slower than the growth of the total number of vehicles

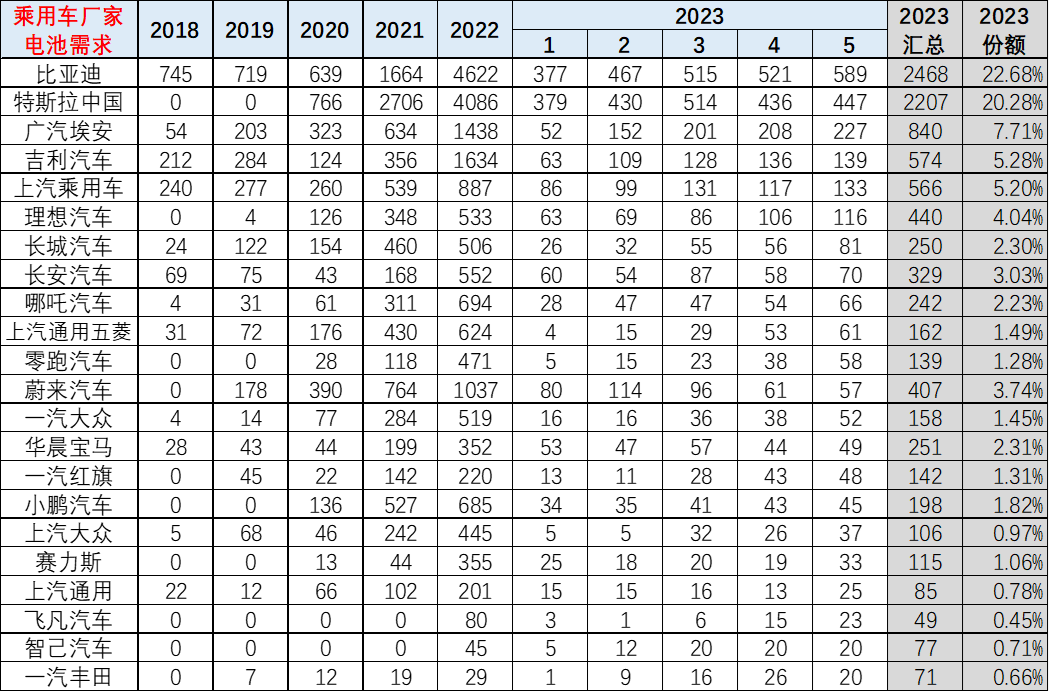

On the enterprise side, BYD and Tesla's two battery demands accounted for 43%, so the advantage of BYD's battery manufacturing is obvious.

Cui Dongshu: The growth of EV battery installation demand is expected to be slower than the growth of the total number of vehicles

From the battery installed ratio, the demand structure of power batteries in recent years is in rapid change. 2020 or passenger cars pure electric first, pure electric bus second, pure electric special vehicles third pattern and plug-in hybrid passenger cars is only the fourth state. And this year, pure electric passenger cars remain in the first place, while plug-in hybrid passenger cars rose to second place, pure electric special purpose vehicles rose to third place, while pure electric buses fell to fourth place level.

In recent years, the pure electric bus market has declined dramatically, while the plug-in hybrid passenger car shows a faster rise, and the pure electric special purpose vehicle maintains a relatively stable feature with battery volume at around 7%.

At present, the pure electric passenger car declines from 18% to a cumulative level of 1% in 2023, a decline of 17 percentage points. Plug-in hybrid passenger car battery usage is growing relatively rapidly and has now risen from 7% to 16% of the level, an increase of 9%, while pure electric increased by 10%, forming a new passenger car as the absolute core of the battery demand characteristics.

Cui Dongshu: It is expected that the growth of demand for EV battery installation will be slower than the growth of the total number of vehicles

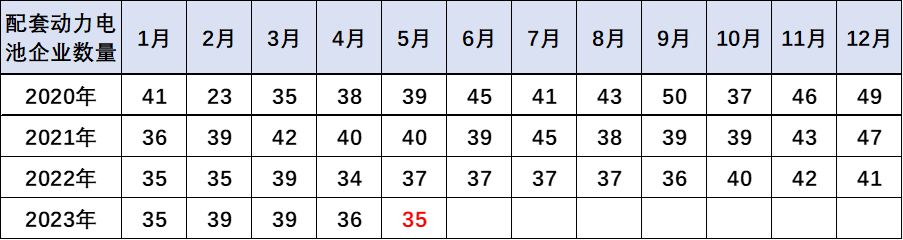

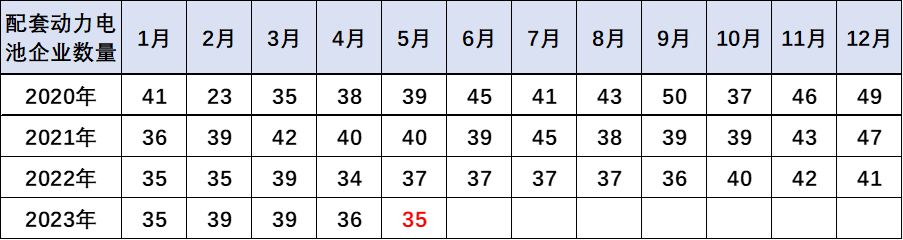

Cui Dongshu pointed out that the supporting battery enterprises are far from full competition. In the past few years, the competitive pattern of the battery market has not changed significantly. As the technical progress of the power battery market is relatively slow, and the scale growth characteristics are relatively obvious, therefore, the battery companies have gained strong production and installed number growth characteristics.

The pattern of the original battery has not changed significantly to see who invests more, and then who can gain a larger market share, thus forming the main battery companies expansion performance continues to be stronger characteristics; while small and medium-sized battery companies also have the opportunity to obtain certain growth by technical or other breakthroughs. Therefore, the battery pattern in the rapid growth should be said to be relatively stable overall.

However, the future of the battery industry change opportunities are relatively large, the future of the whole car enterprises to build batteries or the whole car joint related enterprises to jointly build the battery trend is increasingly obvious, battery companies will gradually form the core of the vehicle supporting products.

At present, the demand for high-end electric car market is not very strong, but similar to the "old man's music" to upgrade to a small micro car, family low-end transport demand is greater, especially of the epidemic, the market demand for A0-class cars and A00-class cars is increasingly high.

In terms of supply chain issues, the future of the vehicle companies will become increasingly powerful, the battery companies, the control of the upstream industry chain will be further strengthened, while the control of the downstream brand marketing capabilities are also being further strengthened. Under the new energy system, the characteristic of "the whole car is king" will be further reflected.

Cui Dongshu: The growth of EV battery demand is expected to be slower than the growth of the total number of vehicles

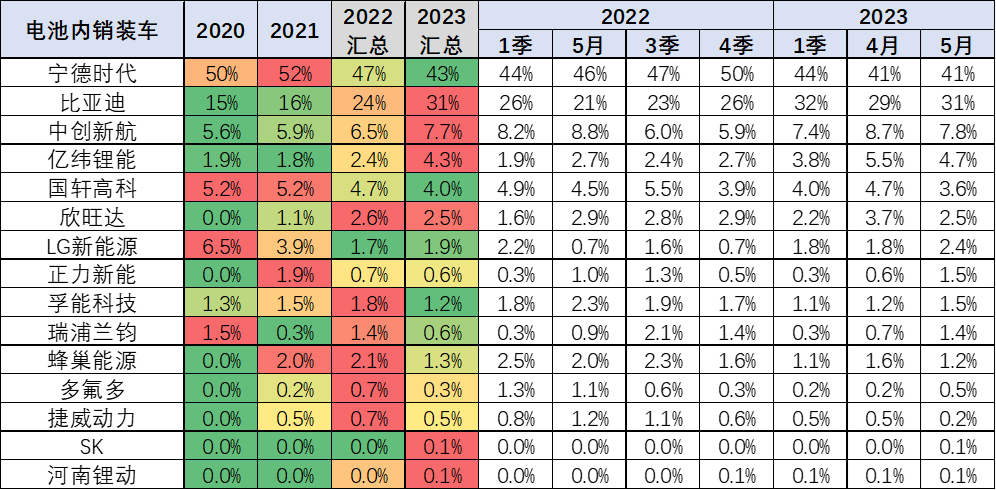

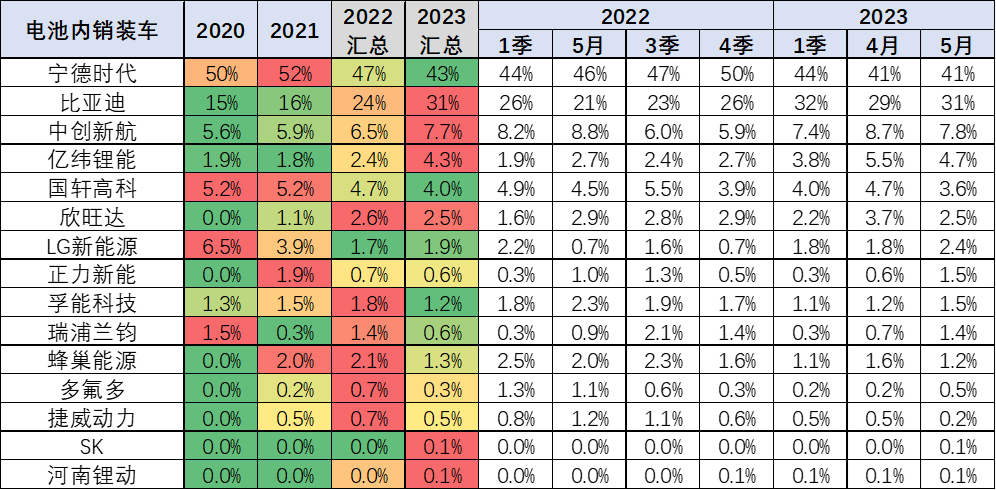

In terms of pattern, the competition pattern of battery enterprises forms Ningde Time and BYD both relatively strong characteristics. At present, the gap between Ningde Time and BYD is shrinking, BYD's share rose from 15% in 2020 to 31%, up 16 percentage points; while Ningde Time's share fell by about 7 percentage points, and the share of other battery companies also showed a significant decline. Battery companies formed the increasingly prominent characteristics of the aggregation effect of the head enterprises, from 65% of the first two enterprises in 2020, rose to 74% of the proportion, and the space of other enterprises only 26% of the proportion.

Next:BYD battery married into Tesla's new car, 15 minutes to charge 60% of the storm

Previous:Global Power Battery Installation Ranking in Q1 2023 – CATL First, BYD Second