Tesla Model 3 still uses catl batteries, both sides may build battery factories in Mexico.

In the past few days, the global power electricity leader CATL has encountered a long-short duel in the capital market, with a thrilling share price performance. And all this is related to whether its largest customer Tesla still uses the company's lithium iron phosphate batteries in the Model 3-related models sold in North America.

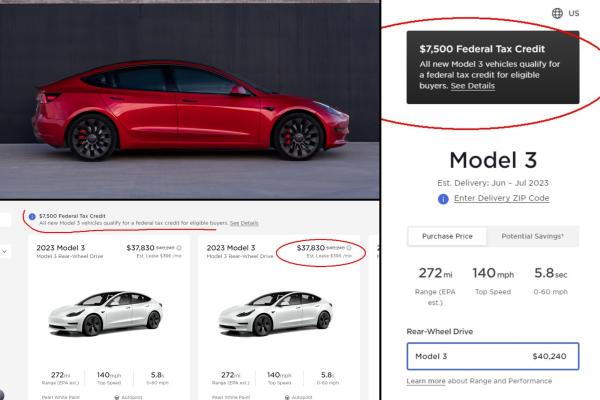

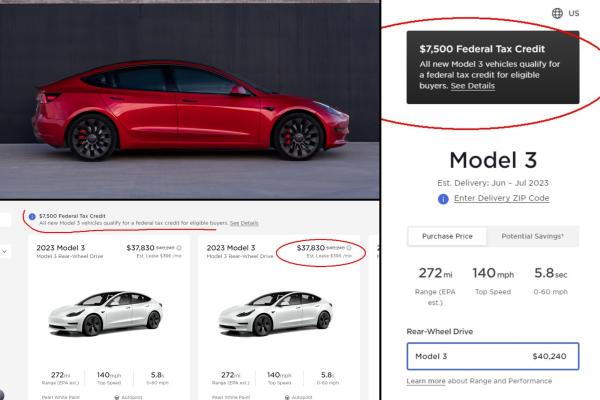

Recently Tesla's official website showed that all Model 3 are miraculously eligible for the full $7,500 consumer tax credit provided by the U.S. federal government's Inflation Reduction Act, which shocked the outside world. Previously, the Model 3 RWD and Model 3 AWD Long Range, which use LiFePO4 batteries from China's CATL, were only eligible for half ($3,750) of the tax credit.

On June 8, according to a new analysis by Citi, Tesla is unlikely to abandon CATL for other suppliers. Analyst Jack Shang and others noted in the report that the Model 3 specs on Tesla's website have not changed and that vehicle weight and range will vary if the battery supply changes. Citi's local contact in the U.S. confirmed with Tesla sales that the battery type has not changed.

And the latest information from Tesla also shows that the Model 3 RWD in the company's existing inventory is also eligible for subsidies, according to the U.S. specialty media auto evolution website. The batteries in the Tesla Model 3 were not replaced overnight with American-made components.

So how exactly did Tesla get the Model 3 all fully subsidized?

As of the time of this article, CATL has not given a clear reply to the surging news reporter.

According to the U.S. Inflationary Subsidy Act, which officially took effect on April 18 this year, electric vehicles must meet the requirements of both the key minerals of the battery and the proportion of localized battery components to obtain a tax credit of $7,500 a car purchased by consumers. Under the premise of meeting the vehicle manufacturing and exclusion of sensitive entities, meeting the key minerals and battery components requirements can each receive a $3,750 tax credit.

In terms of key minerals for batteries, the Inflation Benefit Act requires that a certain percentage of the value of key minerals in batteries (40%/50%/60%/70%/80% for 2023/2024/2025/2026/2027 and beyond) be extracted or processed in the U.S. or in countries with which the U.S. has FTAs, or recycled in North America, with key minerals referring to lithium, cobalt, graphite, nickel and manganese and their constituent materials, the required percentage is 40% this year.

As for the battery components, the battery components manufactured or assembled in North America need to be greater than a certain percentage (2023 /2024/2025/2026/2027/2028/2029 and later 50% /60%/60%/70%/80%/90%/100%), this year's requirement ratio is 50%.

Previously, the surging news reporter learned from many industry sources that Tesla can source key mineral raw materials for batteries, such as lithium, from white-listed countries such as Australia or Canada, thus complying with the mineral raw material origin requirements in the bill. In addition, the procurement of cells from China while assembling battery packs in the United States, rather than directly importing battery packs from China, making more than 50% of the value-added part of the battery pack occurs in the United States, can also meet the requirements.

And according to the latest U.S. specialized media auto evolution website also pointed out that before this, Tesla's Fremont, California factory has been from Shanghai to get the complete lithium iron phosphate battery pack from CATL. Now, Tesla may have switched to producing these packs in the U.S., while still using Ningde's cells.

Not only that but according to an analysis by autoevolution.com, Tesla may have pulled a trick.

That's because the Inflation Reduction Act allows electric car makers to use an alternative method of calculating key mineral content. Under the regulations, Tesla "may calculate a qualifying critical mineral content average for a limited period (e.g., a year, a quarter, or a month) for vehicles from the same model line, plant, category, or some combination thereof." In other words, if Tesla produces enough eligible batteries for the Model 3 on U.S. soil, it can offset the non-compliant portion of the Model 3 RWD from CATL.

But this kind of drilling policy loopholes, in Tesla's view, I'm afraid it's not a long-term solution. Just on June 8, according to 36 Krypton, Tesla is mobilizing many Chinese supply chain companies to build factories in Mexico.

In March this year, Tesla announced that it would build its fifth global mega-factory in Monterrey, the capital of the Mexican state of Nuevo León. The Monterrey plant will be the next stage of Tesla's production stretcher. For its part, the Mexican Ministry of Foreign Affairs has said that the factory will have an investment of more than $5 billion and a planned capacity of 1 million units.

At present, there are already Tesla's Chinese suppliers following in Tesla's footsteps. Ltd. said at the end of March this year, will invest in Mexico to build a production base, a total investment of not more than $ 276 million, in late May, the project was officially launched in Mexico's Coahuila state.

It is understood that Ningbo Sunrise Group Co., Ltd. was established in 2003, dedicated to the field of new energy vehicles and automotive lightweight, the main application areas include new energy vehicle transmission systems, transmission systems, battery systems, suspension systems, and other core systems of precision machining parts. At present, the company has three major processes die-casting, forging, and extrusion, which covers the core aluminum alloy products of automobile power systems, chassis systems, and battery systems.

It is quite interesting that Sunrise Group is not only the supplier of Tesla, but also the supplier of CATL.

Previously, the industry once analyzed CATL will cooperate with Tesla to build a battery factory, so in the future, whether the two sides will avoid the political risk of building a factory in the United States, and turn to Mexico, where labor costs are lower and the automotive industry chain is also mature? Can't help but give rise to more speculation.

Mexico's auto industry association data show that in 2022, Mexico's auto production reached 3.308 million units, ranking sixth in the world, and auto parts output reached 110.5 billion U.S. dollars, ranking fourth in the world. In 2022 Mexico's auto exports were 2.866 million units, and the United States is its most important export country (2.22 million passenger car exports to the United States in 2022, 2021 ($60.1 billion in auto parts exports to the U.S.).

Next:10KWH CATL Megawatts LiFePO4 ESS Battery Module Were Shipped To Toronto

Previous:CATL Kirin Battery Electric Vehicle Has A Range Of More Than 1000 Kilometers