The flagship Waratah Super Battery in New South Wales (NSW), Australia, has been granted Generator Performance Standard (GPS) approval.

The flagship Waratah Super Battery in New South Wales (NSW), Australia, has been granted Generator Performance Standard (GPS) approval.

The Australian Energy Market Operator (AEMO) has determined the large-scale battery energy storage system (BESS) project meets performance requirements for transmission-connected generating and storage systems.

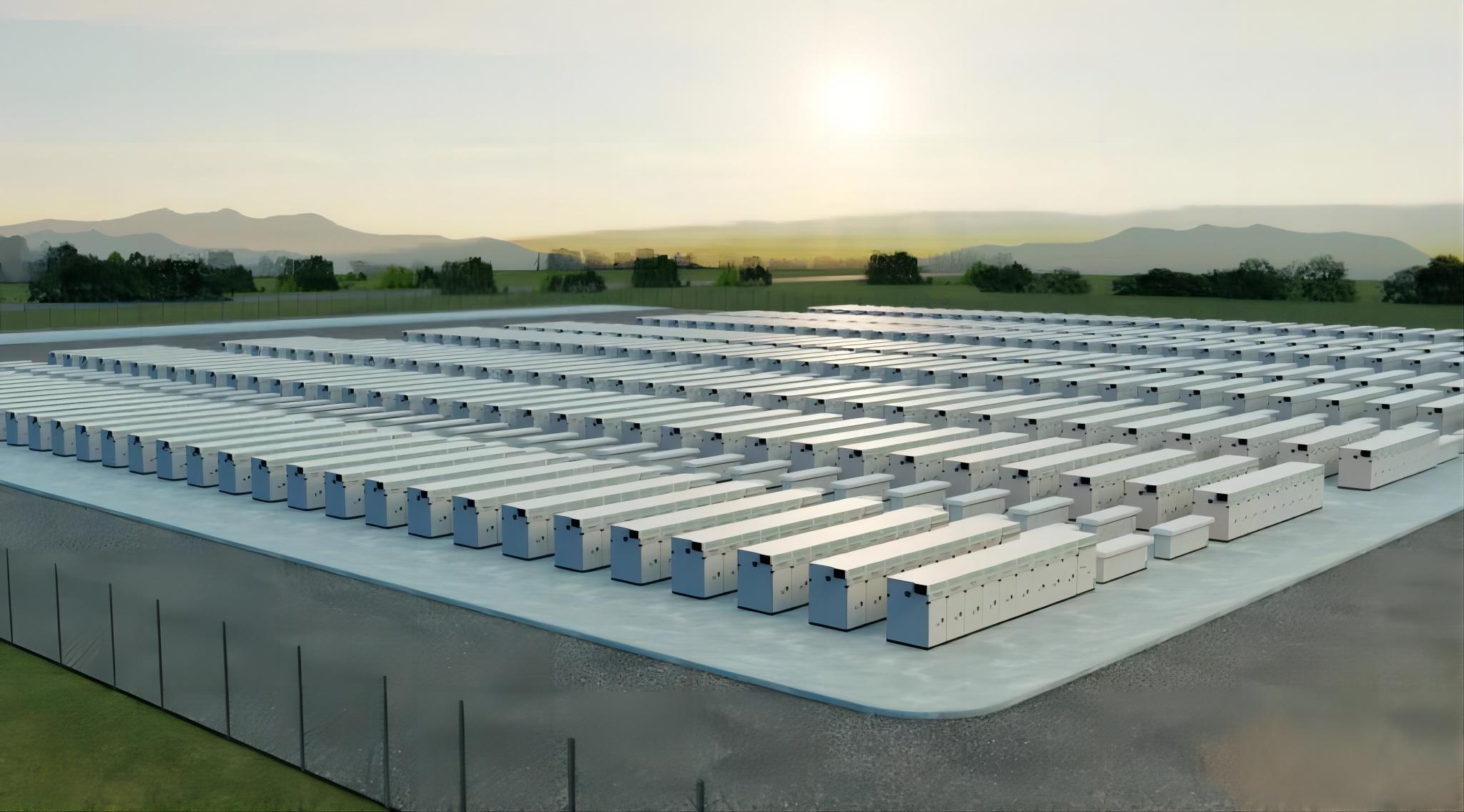

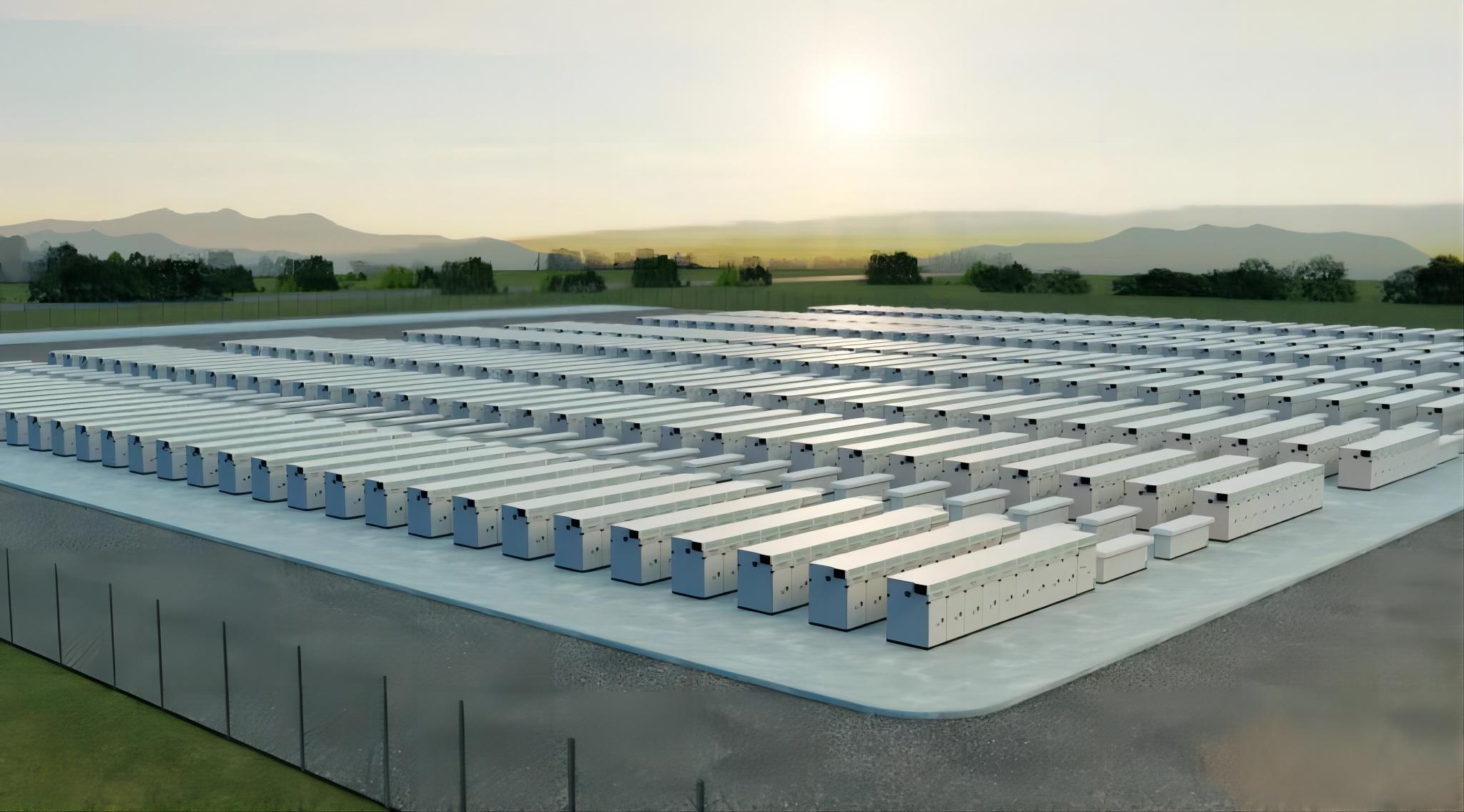

The project has been under construction since May of last year and will have a total power output of 850MW to 1,680MWh storage capacity.

Of that total, 700MW/1,400MWh will be made available to state government-owned EnergyCo NSW, serving as a ‘giant shock absorber’ for the grid under an Energy Service Provider contract. Meanwhile, developer Akaysha Energy is expected to play the remaining stored energy into the National Electricity Market (NEM) on a merchant basis.

EnergyCo said in an announcement yesterday (8 April) that the granting of GPS approval is a “milestone” for the project, claiming that with it, “one of the most substantial technical barriers for the project” has been overcome.

“The approval of the Generator Performance Standard is a significant milestone because the project has passed the simulations needed to know that it can successfully connect to the grid later this year,” EnergyCo executive director for network planning and technical advisory Andrew Kingsmill said.

Battery storage systems for the project are being supplied and integrated by US system integrator and manufacturer Powin Energy. In a recent interview with ESN Premium, Powin executive VP Danny Lu discussed how the project will use 280Ah lithium-ion (Li-ion) battery cells from two different vendors, REPT Battero and EVE Energy, both from China.

The choice of two different vendors for one project helped to de-risk its supply chain procurement and better enable it to get commissioned on time, Lu said.

Powin is working with developer Akaysha Energy on two other large-scale BESS projects in Australia, both in Queensland. Generator Performance Standards (GPS) approval was granted to one of those, the 150MW/300MWh Ulinda Park BESS, in Queensland’s Western Downs region, just before the end of last year, shortly before a FID was made on the other.

The Waratah project is being built on the site of Munmorah, a decommissioned coal plant, and a big driver for its development is helping to replace the power and network services provided historically by Eraring, a coal power plant owned by stock exchange-listed energy generator-retailer (‘retaile) Origin Energy.

“Connecting energy projects to the Australian grid poses unique challenges due to stringent interconnection standards resulting from a combination of an inherently weak electrical grid, strict performance requirements, and high renewable energy penetration,” said Nick Carter, CEO of Akaysha Energy.

Carter said the process of getting GPS approval had taken more than a year. The CEO said that Powin Energy and power conversion system (PCS) supplier eks Energy – which Powin owned until it was recently sold to Hitachi Energy – provided support on the ground which was “critical” in securing the approval within the required timeframes as well as the pair’s advanced technology and willingness to work with Akaysha’s interconnection partners, including consultancy Aurecon.

Incidentally, while Waratah Super Battery was found to be the largest project of its type under construction in Australia during 2023 by the national trade group Clean Energy Council (CEC), and the country’s biggest overall so far, it has been overtaken by a 500MW/2,000MWh project in Collie, Western Australia, which kicked off construction in March, supported by that state’s government.

Controversial twist for doomed coal power plant

Waratah Super Battery has been deemed a Critical Infrastructure project by the NSW government, which has invested directly in the project towards its capital cost. It is expected to go fully into commercial operation in August 2025. This would have been around the same time as Eraring’s planned retirement. However, there has been controversy over the last few months.

Origin Energy said in September last year that it would request assistance from the state government to keep the 2,880MW plant open past 2025, claiming that its closure would endanger the security of the energy supply.

Conversely, environmental and local community groups have produced studies showing that keeping it open would endanger lives while costing the taxpayer more money for short-term system stability than investment in renewables and storage.

A decision from the NSW government is expected soon.

Origin presented a plan to investors in 2022 that would see Eraring replaced with the company’s own large-scale BESS project, expansion of Origin’s virtual power plant (VPP), and increased utilisation of the company’s natural gas peaker plants. The initial 460MW/920MWh phase of the ba